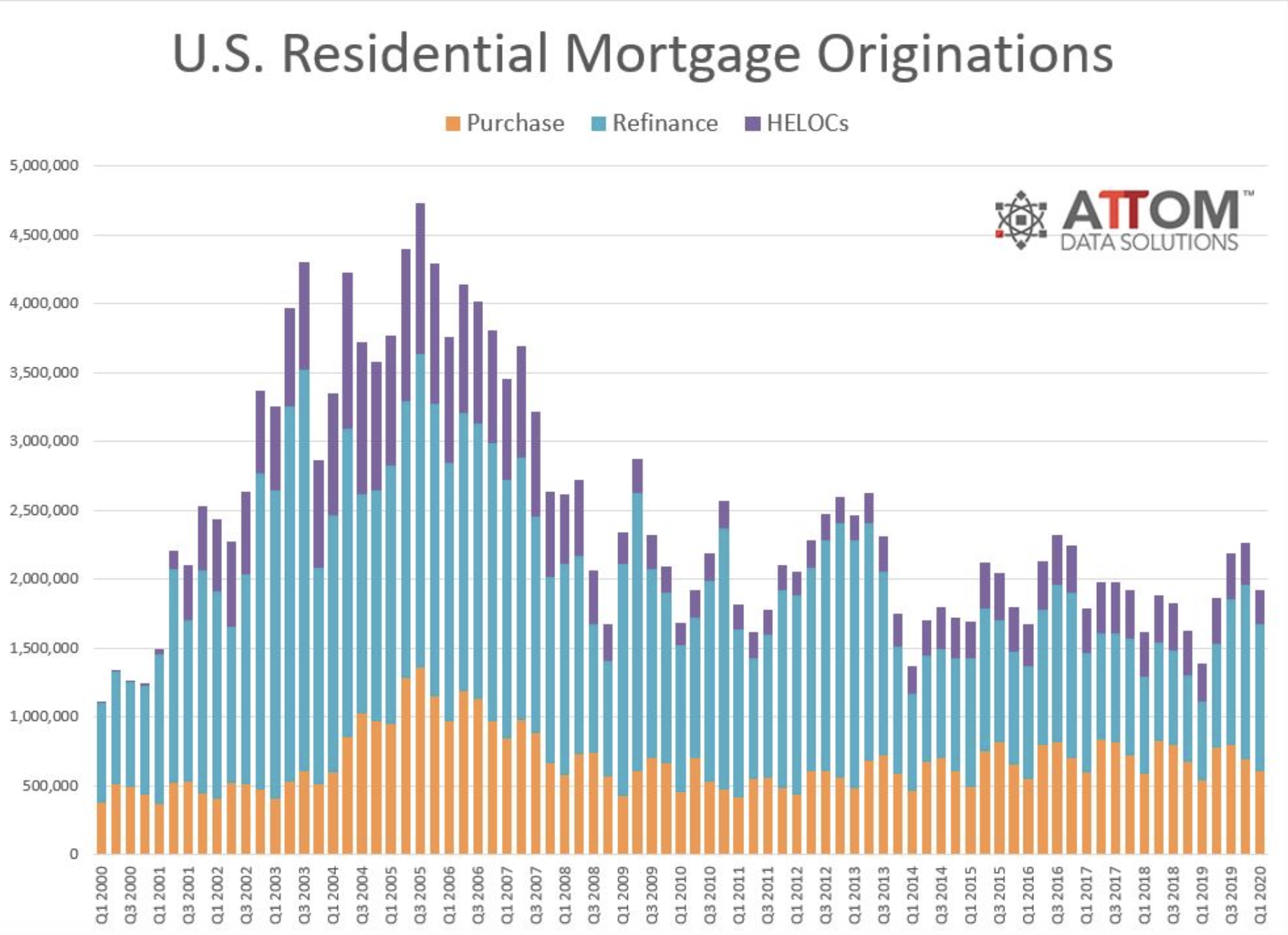

During the first quarter 1.07 million residential refinance mortgages were originated in the U.S., a drop by 16 percent from Q4 2019, but still up by 87 percent from Q1 2019.

Spurred by historically low interest rates, new refinances made up about $328.5 billion in total dollar volume. While that number was down by 16 percent quarter-over-quarter, it was up by 105 percent year-over-year.

“Home-loan data was way up again in the first quarter of the year, with refinancing activity again accounting for more than half the total volume of mortgages,” Todd Teta, chief product officer at Attom Data Solutions, said in a statement.

“The number and dollar value of home loans marked yet another sign of how charged up the U.S. housing market continued to be in the early months of the year when everything was still pointing in the right direction,” Teta added. “Unfortunately, that is all uncertain now due to the economic fallout from the virus pandemic that could throw the market into a downturn.”

However, refinance originations did decrease in six metro areas, with two Texas cities — McAllen (down 29.3 percent) and Beaumont (down 13.4 percent) — seeing the biggest drops. Amarillo, Texas (down 0.4 percent); Syracuse, New York (down 1 percent) and Youngstown, Ohio (down 0.4 percent) saw minor drops.

Purchase mortgage originations also rose across the nation by 13 percent year-over-year to 606,703 residential purchase originations. That number, however, was down by 12 percent from Q4 2019.

The greatest increases year-over-year in purchase mortgage originations were in Savannah, Georgia (up 299 percent); Lafayette, Louisiana (up 230.9 percent); South Bend, Indiana (up 143.4 percent); Los Angeles (up 121.7 percent) and Ventura, California (up 115.5 percent).

Residential purchase mortgage originations decreased notably in the following metro areas, however: Myrtle Beach, South Carolina (down 47 percent); Port St. Lucie, Florida (down 42.2 percent); Lubbock, Texas (down 40.9 percent); Lincoln, Nebraska (down 39.1 percent); and Amarillo, Texas (down 38.7 percent).

Originations of home equity lines of credit (HELOCs) dropped by 20 percent quarter-over-quarter and by 11 percent year-over-year. However, HELOC mortgage originations did rise in about 25 percent of metro areas, counter to the national trend, including in Fort Wayne, Indiana (up 78 percent); Topeka, Kansas (up 47.1 percent); Youngstown Ohio (up 44.1 percent); El Paso, Texas (up 44 percent); and Rochester, Minnesota (up 42.7 percent).